An attorney friend of mine called wanting some help comparing new office lease opportunities. She did some homework on two different spaces, but was confused by the language describing the measurements of the space. Specifically, usable versus rentable square feet, common areas, and common area charges. Her question was how to compare lease options when the terms they use to describe them are different, but the numbers are the same? This confusion is common, understandable, and largely centers around the fact that math is involved. Let me try to decipher terms, and explain the math.

What is Rentable Square Feet?

Rentable square feet are the number of square feet that a tenant is actually charged for. Generally speaking, the total rentable square footage is the entire footprint of the building, except for the common areas. (We’ll talk about those in a minute).

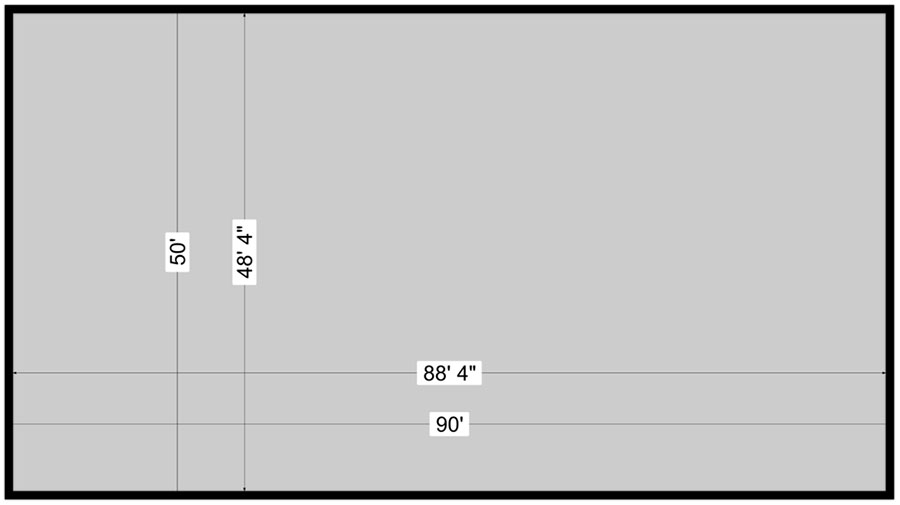

Consider the simple building above. This 90′ x 50′ building totals 4,500 square feet. Those measurements are taken from the outside of a wall to the outside of the opposite wall. Remember, Landlords usually measure from the outside of exterior walls, and to the middle of interior walls. Thus, if this building has one tenant, the rentable square footage is also 4,500 square feet.

So What is Usable Square Feet?

Generally speaking, usable square footage is the number of square feet inside the space you lease. Its the amount of space that you actually get to use, where you are going to conduct your business. There are no exclusions for columns/posts, recessed walls, and the like. If it’s inside your walls, it’s usable square feet.

Consider our example building again. Same 90′ x 50′ building, same 4,500 rentable square feet. But because of the 10″ thickness of each of the outside walls, the interior measurements are only 88’4″ x 48’4″, and this results in only 4,269 usable square feet to a tenant leasing the entire building. As you can only use the area within the exterior walls, that square footage is deemed usable. For these reasons, and more that we will talk about below, usable square will always be less than rentable square feet.

What are Common Areas?

Generally speaking, a “common area” is space in a multi-tenant building that is shared by all of the tenants in the building. It is not usable square feet because it is outside the walls of a tenant’s space. It is other square footage that is is “common” to, and typically used by, all tenants.

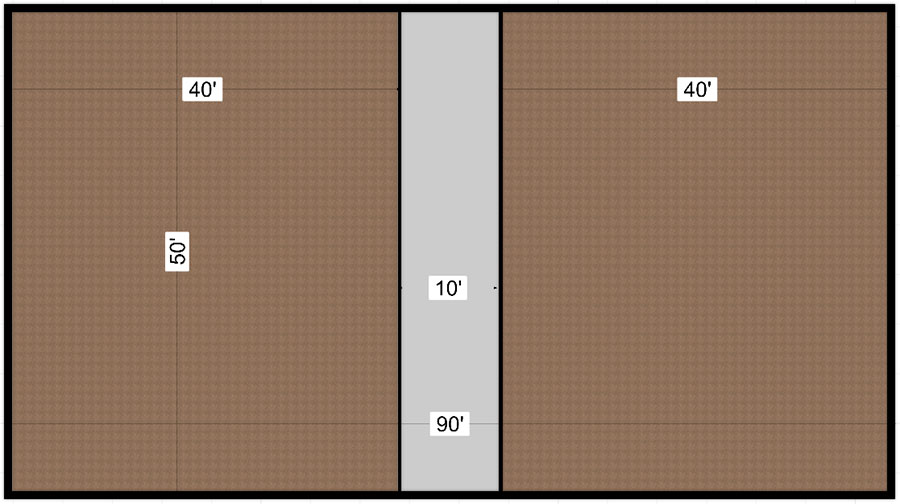

Above, our Landlord has divided our 4,500 square foot building into two 2,000 square foot office suites. In between those suites is a corridor that runs the full width of the building. This 10′ x 50′ corridor is used by both tenants to access their office space. Thus, it is deemed a common area. Note that when multiple tenants are involved, and common areas added, the total rentable square footage goes down. Here, the rentable square footage is only 4,000 sf.

Interior common areas typically include stairwells, elevator shafts, risers, common restrooms, conference rooms, kitchens, corridors, etc. They also include areas outside the building, like walkways, parking lots, etc. Generally speaking, it is any area that all the tenants can use, or benefit from.

How Does A Landlord Charge for Office Space?

So our Attorney Friend explained that she is considering two different spaces. Each one is advertising “$17.00 PSF + $3.50 CAM.” She is not quite sure what all that means.

Taking them in order, typically when a Landlord advertises space for lease, the dollar figure given is per rentable square foot, per year. So if our Attorney is looking for 2,000 square feet, she will pay $17 per rentable square foot for a year, or $34,000.00. To determine the monthly rate, divide that number by twelve, and you get $2,833.33 per month.

CAM is an acronym for “common area maintenance.” We explained what common areas are above. Because these areas need to be maintained, and no one tenant has control of them, the Landlord typically handles the maintenance and then passes the costs through to the tenants.

What do CAM charges include? That is a long and variable list. The type of building, as well as its geographic location will play a role in determining these charges. Some or all of the following can be included in CAM charges: cleaning service, HVAC, HVAC maintenance, electric for parking lot lights, snow plowing a parking lot, landscaping, trash removal, etc. Click here for more.

In the case of our Attorney friend, she has two landlords that are each charging $3.50 for CAM. What does this mean? Well, because all tenants share the common areas, the charges to maintain those common areas are also shared by all the tenants. This is where the math comes in.

CAM charges are typically charged on a pro-rata basis, meaning that each tenant pays its proportional share of the expenses. The proportion is based on the rentable square feet a tenant leases in a building against the total rentable square feet. For example, in our 4,500 square foot building with two 2,000 square foot spaces, as we said above, the total rentable square feet. equals 4,000. Thus, each tenant would be responsible for 50% of the common area charges because each leases half of the 4,000 rentable square feet.

How to Compare Lease Options

So, our Attorney has found two spaces. She believes that because the buildings are the same size, that they both offer a 2,000 sf space, and the rent and CAM charges are the same ($17.00 psf for rent, and $3.50 psf CAM), then cost wise, they must be equal.

NOT SO FAST my friend! That is simply not always the case. And in her particular situation, one of those spaces costs more than the other. Let’s compare these lease options.

Let’s take a look at her two buildings:

Option A is the building we have been working with. Two 2,000 sf spaces in a 4,500 sf building. A total of 4,000 rentable square feet with 500 sf of common areas.

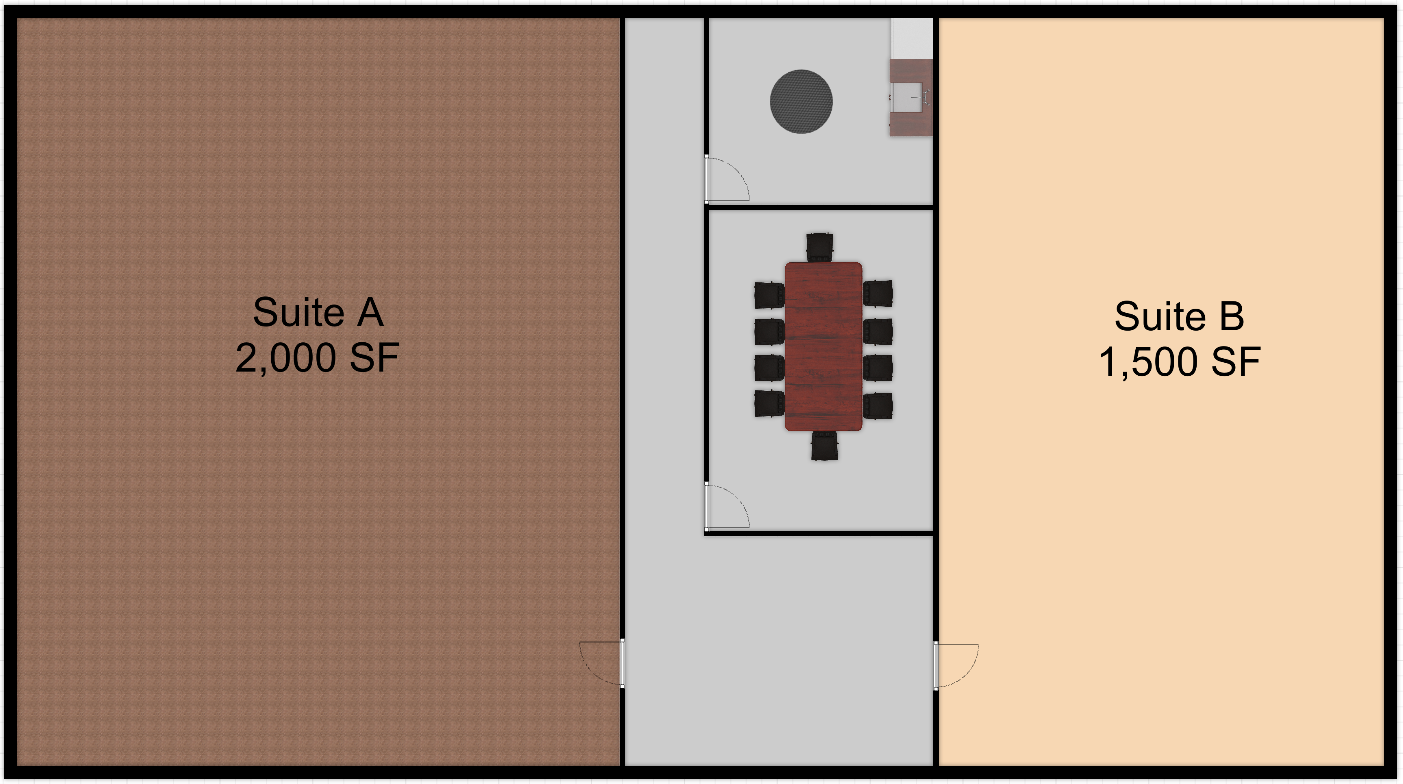

Option B, is another 4,500 sf building. In this building, while it has the 2,000 sf space our Attorney is looking for, the other space is only 1,500 sf. The remainder of the space is common areas, in this case, made up of a conference room, and a kitchen. As discussed, as common areas, they are available to both tenants. Thus, Option B only has 3,500 rentable square feet.

While at first blush, these two options seem to be the same (all the numbers are the same), there are two key differences. First, the common area size is different. Option A offers 500 sf of common area. In Option B, the common areas equal 1,000 sf. All other things being equal, you will responsible for the maintenance of twice as much space in Option B.

Second, the rentable square footage of these properties is different. Option A offers two 2,000 sf spaces for a total of 4,000 rentable square feet. Option B, on the other hand, has a 2,000 sf and a 1,500 sf space, for a total of only 3,500 rentable square feet. This is important, because the pro-rata allocation of responsibility for common areas is different.

In Option A, our Attorney will be leasing 1/2 of the rentable square feet, and thus responsible for 1/2 of the common area maintenance charges. But in Option B, she would lease 2,000 of the 3,500 rentable square feet, on a pro-rata basis (2000 / 3500 = 0.57) she would be responsible for 57% of the common area charges.

Let’s explore how these two differences affect what the Attorney will pay each year for each Option:

| Option A | Option B | |

| Rent: $17 psf per year | $34,000 | $34,000 |

| CAM: $3.50 psf per year | $875 | $1,995 |

| Total Rent | $34,875.00 | $35,995.00 |

As is obvious, the cost of Option B is more than $1,000 per year. Why? Because it has less rentable square feet AND more common areas. Thus, despite the fact that all the numbers for both properties were the same, the costs were different.

Conclusion

While our examples above were greatly simplified for explanation purposes, this will give you a basic understanding of how to compare lease options. Of greater import, however, is to make sure you are seeking the help of a trusted professional commercial real estate broker that can help guide you through issues like those presented here. As demonstrated, just because the numbers are the same, does not mean that the costs are the same. If you ever have a need, give me a call and I’ll be happy to walk you through the comparisons.